All Categories

Featured

Table of Contents

The tax obligation lien and the cancellation of the lien are thought about public info as soon as enrolled on the State Tax Lien Registry. The Division of Profits does not control the credit bureau agency's plan relating to the size of time or the accuracy of the information they continue a debt bureau report.

You might send a duplicate of this notice to the debt bureau(s) and inquire to to modify or to eliminate a lien from a credit report bureau record. Circuit clerks need to use the Lien Computer System Registry Assistance Form. Directions for reporting are consisted of on the type. For additional inquiries, comments or worries call 601-923-7391 or email taxliens@dor.ms.gov!.?.!. Individuals and businesses that have actually not paid their taxes might have a certificate of lien filed with the recorder of deeds and the circuit court in the area where the private stays or business is located. The certification of lien submitted with the recorder of acts affixes to the taxpayer's genuine and personal effects.

The Department of Earnings does not report lien info directly to the credit rating bureau agencies. Nonetheless, the tax obligation lien and the cancellation of the lien are taken into consideration public information once filed with the recorder of acts or the circuit court. The Division of Profits does not control the credit scores bureau company's plan concerning the length of time or the accuracy of the information they continue a credit history bureau report.

Tax Lien Investing Secrets

Please contact the circuit clerk or the recorder of actions in the county in which the lien was filed to get official information concerning the lien.

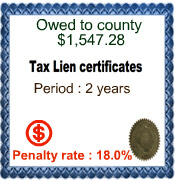

Every year, overdue tax obligations are available for acquisition at the Tax Lien Sale. Here are some realities to assist you comprehend what a tax obligation lien sale financial investment is, and is NOT: When you acquire a tax lien sale certification on home, you come to be a lienholder on the building. Fundamentally, you finance funds to the proprietor to pay taxes.

Tax Lien Investing Books

In Douglas County, eventual transfer of action has occurs in less than 1 percent of all purchases. Buying tax liens with purchase at tax lien sale is just that an investment. The State Financial Payment determines the price of return. The yearly rates of interest is set at 9 points above the government price cut price since Sept.

Municipalities can later foreclose the civil liberties of owners to retrieve the home (to get clear title to the residential property returned to them by paying the taxes). Districts deserve to take control of ownership of the property. While tax obligation title procedure assists cities and towns that need the cash to work, it can be a fantastic difficulty to those who could be losing their homes.

, municipalities might sell tax obligation responsibilities to third-party investors at several points in the tax obligation foreclosure process (as receivables, liens or tax titles) to increase prompt earnings. The exclusive financier stands in the municipality's footwear to gather the responsibility and continue the tax obligation repossession process.

Getting time to place with each other a plan to pay back taxes and redeem title to the genuine estate can be vital for overdue taxpayers.

60 68. "Comprehending the Tax Foreclosure Refine" offers a detailed recap of Tax Title Profits and Repossession procedures in product that came with a 2005 seminar. Lawful assistance for those encountering foreclosure of the legal rights of redemption in their residential or commercial property may be available through Limited Assistance Depiction. Minimal Support Depiction (LAR) is available to any party who feels she or he can not afford or does not desire an attorney for the whole situation, but could utilize some help on a restricted basis.

How To Invest In Tax Liens

Spending in tax liens and actions with self-directed IRAs are appealing financial investment strategies because they are rather easy and inexpensive to get and handle. And, they have the prospective to make a desirable return on the initial investment. When you utilize retired life funds to spend, the liens and/or actions are acquired by the self-directed individual retirement account and are had by the IRA.

Advanta IRA manages many financial investments in tax liens and acts in self-directed Individual retirement accounts. Tax obligation liens are affixed to property when owners stop working to pay annual residential or commercial property tax obligation.

Governing agencies offer these liens at online or on-line public auctions. Investors who win the quote pay the tax obligations due. The investor appoints and collects a collection interest rate and charges from the residential property proprietor. The residential property owner has a set durations pay the financier to get the lien released from the residential property.

In instance of default, the capitalist can take possession of the building and can offer it outrightanother means to earn earnings. Tax deeds work just like tax obligation liens when home tax obligations are in arrearswith one essential exception: the government or community takes immediate possession of residential or commercial property. Tax actions are after that marketed at public auction, and the capitalist with the highest possible bid wins ownership of that building.

As of November 1, 2019, the SCDOR records specify tax obligation liens online in our comprehensive State Tax obligation Lien Registry at . The windows registry includes all unsettled state tax obligation liens that were previously filed with county workplaces. State tax obligation liens are currently provided and satisfied with the SCDOR, not area workplaces.

Tax Lien Certificate Investing

The current lien equilibrium on the State Tax obligation Lien Computer system registry includes payments made toward the debt and added charge and passion built up. If a taxpayer owes the SCDOR and disregards or fails to pay a tax financial debt, the SCDOR can release a state tax obligation lien. A state tax lien is a claim against your genuine and/or personal effects located in South Carolina.

State tax obligation liens are energetic for 10 years. You can not sell or refinance your building until you pay off your tax lien and get a clear title.

Is Buying Tax Lien Certificates A Good Investment

, discover the lien you need documentation for making use of the search. Once you've found the right lien, click the number in the to watch the or click the date in the to view the notification.

A state tax lien is not provided till the opportunity to appeal the debt has actually already passed. If you believe the lien was submitted at fault, contact us quickly at ComplyToday@dor.sc.gov - investing in tax liens certificates.?.! with supporting documentation. After entering your search, utilize the State Tax obligation Lien Filter bar to improve your outcomes. Kind the you wish to filter by, followed by much less than (), higher than(), or equivalent to (), and your filter requirements in quotes. Investors can buy residential or commercial properties with tax obligation

liens at auction, potentially gaining possession of the building if the lien is not redeemed within a specified duration. Many financiers are drawn to tax lien residential or commercial properties because they have a potential for a high return on their investment. If the residential or commercial property owner stops working to pay the back tax obligations and redeem the lien, the investor can potentially get the residential property for a portion of its market price. Tax obligation lien residential or commercial properties can also provide a different investment option, enabling investors to expand their portfolios. While the appeal of tax obligation lien residential or commercial properties is solid, there are several risks and considerations that real estate agents should notify their clients about. In North Carolina, the residential or commercial property proprietor has a redemption period during which they can pay back the back tax obligations, passion, and charges to redeem their residential property. Because they are foreclosure sales, residential or commercial properties with tax obligation liens are frequently offered "as-is.

"Financiers must understand that theseresidential properties may be in inadequate condition and can need considerable repair work. Having a complete evaluation carried out by a specialist prior to acquisition is essential. A tax obligation lien does not necessarily snuff out various other existing liens or encumbrances on the residential or commercial property. Navigating the redemption duration, prospective repossession, and other lawful demands demands a solid understandingof North Carolina's tax lien legislations. This is once more why it's important to include a seasoned genuine estate attorney at the start of the procedure. Also if investors acquire the property, they should take into consideration the local property market conditions. At Starling Law Practice, we recognize the intricacies and risks related to purchasing tax lien residential properties. Our knowledgeable team is right here to give the legal support and support needed to guarantee a smooth and successful financial investment. Group up with us on your property purchases to protect your clients'interests and accomplish the most effective feasible results. This sale will be for unpaid 2023 Real Residential property and Severed Minerals. A full checklist of tax liens offered for sale will be offered in September in the Routt County Treasurer's Workplace or online at Official Tax Lien Public Auction Site. If a tax lien is mistakenly offered and the Region needs to pay the certification owner the redemption passion, the price will be determined as stated in Section 39-12-111, Colorado Changed Laws. all taxes have to be accumulated. The yearly tax lien sale is held to accumulate unsettled taxes. Liens are positioned versus the residential properties and are purchased by investors that, subsequently, make passion against the tax amounts (Passion is paid on the tax obligation lien, but out the costs). The passion amount is figured out annually on September first and is 9 percent above the federal discount rate( rounded up). Normally an effective bidder pays a superior price over the tax obligation liens that are offered in order to purchase a tax obligation lien certificate. The Routt Area Tax Lien Sale is an on the internet auction. or get in touch with SRI at 1-800-800-9588.

Latest Posts

Buying A House With Delinquent Taxes

Delinquent Tax Sale Properties

Tax Lien Investing Pitfalls